Funding & Financing

A good idea alone doesn't get rewarded with funding. There is a process. We can help.

Securing investment capital requires a great horse, farm, trainer, and jockey!

Your idea is the horse, your company the farm, the trainer your advisory board, and your executive team the jockey. Before approaching a potential investor for investment capital, you need to understand what makes them tick, what gets them excited and interested.

Members of our team (and sister company team at A2Z Business Consulting) have experience raising investment funding, writing REG-A offering circulars, and running publicly traded companies. We have the knowledge to guide you and craft the documents you'll need.

Branded project overview documents can vary depending on your business, investment opportunity, and industry. But there are some standard documents that investors will want to see, as much for the information as for confirmation that you know how to create them. Among these are:

- One-Sheet

- 5 Force Chart

- Lean Canvas

- Pitch deck

- Business plan (Executive Summary, or full) and,

- Marketing Plan.

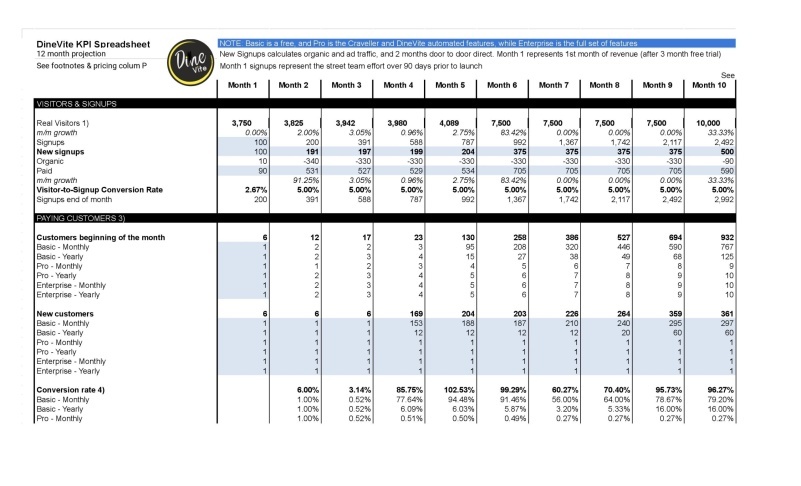

Equally crucial for investors are financial documents, which should include, but are not limited to:

- KPI chart (costs, income, break-even, churn, runway)

- Use of Proceeds [detailed]

- Financials and financial projections

To strengthen your investor package, your financial forecast should also cover:

- Revenue projections

- Cost of goods sold (COGS)

- Operating expenses

- Net profit/loss

- Cash flow projections

- Breakeven analysis

- Key performance indicators (KPIs) relevant to your business model

Providing a thorough, transparent set of metrics not only demonstrates your understanding of the numbers but also instills confidence in potential investors.

Our team has designed and created all versions of investor documents. If necessary, A2Z Business Consulting can assemble the market research and crunch your numbers.

What Is Financial Forecasting for Startups?

You don’t need a crystal ball—but you do need a map. Financial forecasting is simply the process of projecting your startup’s economic performance over the next few years, typically focusing on revenue, expenses, cash flow, and profitability. Think of it as plotting your route before you hit the track—no champion racehorse starts a run without knowing where the finish line is.

So, what goes into a solid financial forecast? It means building educated estimates around:

- How much you expect to sell (sales forecast)

- What it’ll cost to operate (expense forecast)

- When you’ll reach breakeven (breakeven analysis)

- How cash will move in and out of the business (cash flow projection)

For investors and lenders, these numbers are key. They want to see when your “horse” (your idea) starts outrunning its expenses and becomes self-sustaining. Financial forecasts help them gauge your business’s runway, its ability to meet obligations, and its potential for long-term growth. Just as important, a well-crafted forecast signals that you know your numbers inside and out—a reassuring sign for those who might back your venture.

But forecasting isn’t just for external show. As a founder, these projections become your guideposts—helping you plan, make wise decisions, and steer around trouble long before it appears. Unlike broad financial planning (which is more about setting the vision and direction), forecasting grounds you in the present, drawing from both your own data and the track records of similar businesses to make logical, informed estimates.

Remember, financial forecasting is about direction, not perfection. It won’t be 100% precise, but when built on realistic assumptions and careful research, it’s a crucial tool for both attracting funding and building the confidence to drive your business forward.

Why Financial Forecasting Matters for Startups

So why is financial forecasting such a big deal for early-stage companies? It’s simple: a well-crafted forecast isn’t just a hoop to jump through for investors—it’s your blueprint for decision-making and survival.

Investors and lenders, of course, want to see projections that go beyond hope and hype. Before they hand over a check, they’ll examine your breakeven point (when your revenues overtake expenses), projected cash flow (can you actually pay your bills next quarter?), and your best guess at sales and costs. These forecasts help demonstrate that you understand your venture’s financial landscape and have a plan in place—not just a passion for your product.

But the real value? A robust forecast gives you clarity. It highlights when you might need a cash reserve, if you’ll face shortfalls, or when to seize growth opportunities. Unlike long-term strategic plans, financial forecasting focuses on specifics, using real numbers and current trends to map the road ahead. It isn’t accounting—which looks back—but rather a forward-looking exercise that draws on what has happened before to anticipate what comes next.

Your financial forecast should never be carved in stone. Update it regularly—every six months or whenever significant changes occur—so it stays relevant as your business evolves. The numbers and assumptions should genuinely reflect your current position, potential pitfalls, and growth milestones. Done well, forecasting helps avoid nasty surprises, keeps your team on track, and shows potential backers that you’re steering with both hands on the wheel.

Common Forecasting Missteps to Avoid

When preparing your financial forecasts, one common mistake we see founders make is painting an overly optimistic picture—often expecting revenues to rocket up in the shape of a “hockey stick.” While it’s great to dream big, most seasoned investors see right through projections that leap from stagnant sales to meteoric growth overnight. These types of forecasts tend to raise eyebrows and can actually undermine your credibility.

A few other pitfalls to steer clear of:

- Ignoring market realities: Overestimating market size or your potential market share can quickly derail your forecast.

- Underestimating costs: Failing to account for operating expenses, customer acquisition costs, or churn rates will leave holes in your financials.

- Lack of rationale: Numbers thrown out without data or explicit assumptions won’t inspire confidence. Ensure you can back up your projections with solid research and benchmarks (think CB Insights or Crunchbase metrics for your sector).

- Static projections: Assuming steady, linear growth without factoring in seasonality, competition, or market shifts can result in unrealistic expectations.

Being transparent about your assumptions and using conservative, data-driven estimates will help build trust with potential investors—and keep your business plan grounded in reality.

Boosting the Accuracy of Your Financial Forecasts

Getting your financial forecasts right is critical—both for your own strategy and for impressing potential investors. Startups often stumble here, but a few savvy tactics can make a world of difference.

Here’s how we recommend approaching it:

- Leverage your numbers, but look outward too. Don’t just rely on your own historical figures—seek out industry benchmarks to ground your estimates in reality.

- Churn Rate is something many forget to include. If you don't factor churn rate into your KPIs, the results will be significantly inaccurate.

- Lean on caution. Accurate forecasts don’t involve wishful thinking; temper your projections with conservative, well-justified assumptions.

- Schedule check-ins. As the market shifts and your business evolves, regularly revisit and refine your forecasts, adjusting them as you gain new data.

- Don’t go it alone. Consult experienced financial professionals or advisors when modeling the future. Their insights can highlight blind spots and surface critical details.

- Engage your core team. Ask for feedback from key stakeholders—your marketing, sales, and ops folks know what’s realistic vs. Optimistic.

Combining these habits can help produce forecasts that are trusted, actionable, and ready to stand up to investor scrutiny.

Why Cash Flow Projections Matter in Startup Financial Forecasts

Investors—much like discerning trainers sizing up a promising mare—are deeply interested in cash flow projections when reviewing a startup’s financials. That’s because a detailed cash flow forecast reveals whether your business can cover its bills and obligations while it’s finding its stride. In the KPI chart, it is referred to as your "runway"—the time before your cash runs out.

Think of your cash flow projection as the course map for your journey: it shows how much cash you’ll need and when, flags potential shortfalls before you’re “out of runway,” and keeps both founders and investors attentive to when additional funding (through loans or equity) might be required.

Without precise, thorough cash flow projections, even the most brilliant idea may stumble. A well-prepared forecast not only shows you’ve got a grip on the numbers—it lets investors see at a glance that you’re prepared for surprises and poised to stay in the race.

Approaching Early-Stage Sales Forecasting

Forecasting sales as an early-stage startup can feel a bit like peering into a crystal ball—equal parts art, science, and levelheaded guesswork. The key is to ground your projections in informed assumptions rather than wishful thinking.

You can start by sizing up your total addressable market (TAM). In simple terms, this means identifying who might buy your product if everything goes your way—consider demographics, geography, and specific industries. For instance, if you’re rolling out a medical device for remote heart monitoring, estimate how many patients and healthcare providers would realistically use it, and what similar products exist in the market.

Next, break your forecasts into bite-sized chunks:

- Monthly Estimates: For the first two years, keep your projections granular. Project anticipated unit sales and pricing on a month-by-month basis.

- Quarterly Beyond Year Two: Once you have some traction, switch to quarterly projections, allowing more flexibility as your market position evolves.

Ground your numbers in real-world data as much as possible. Analyze competitor performance, gather industry reports, or even run pilot tests and surveys to validate your assumptions. Avoid the temptation to promise explosive "hockey stick" growth—most savvy investors have seen their fair share of these and know they’re rare.

Lastly, remember that forecasting is a living process. Tweak your estimates as you gather real sales data, adapt with market conditions, and, above all, be transparent with your investors about your assumptions and methods. This approach signals both competence and credibility—traits that leave a lasting impression long after your pitch ends.

Best Practices for Managing and Updating Financial Forecasts

To keep your financial forecast functional—and credible to investors—treat it as a dynamic tool rather than a one-time exercise. Think of it like regular maintenance for your top racehorse: tune-ups are non-negotiable.

Here’s what savvy founders and execs should do:

- Review your forecasts at least twice a year, or more frequently if your industry is volatile or your business is rapidly evolving.

- Update underlying assumptions promptly whenever there are significant shifts—new revenue streams, cost changes, market disruptions, or pivoted business strategies.

- Capture both wins and setbacks. Adjust projections to reflect actual performance, not just best-case scenarios. Investors value realism over optimism.

- Document assumption changes. Make careful notes about why and when adjustments are made—think of it as your forecast’s “lab notebook.”

- Benchmark against peers. Compare your latest numbers against industry norms using reputable sources such as CB Insights, Statista, or McKinsey reports to ensure your projections pass the sniff test.

- Share updated versions with key stakeholders. Keep your team, board, and current investors in the loop—regular communication builds trust and lets everyone steer together.

Our team has designed and created all versions of investor documents. If necessary, A2Z Business Consulting can assemble the market research and crunch your numbers.

Understanding Fixed vs. Variable Expenses—and Their Role in Your Forecast

When it comes to mapping out your startup’s financial future, understanding the difference between fixed and variable expenses is your first checkpoint.

Fixed expenses are costs that recur each month, regardless of whether your sales increase, decrease, or remain flat. Think office rent, insurance policies, employee salaries for key staff, and regular loan repayments—expenses that run like clockwork. Since you can count on them repeating, fixed costs are predictable and make budgeting easier.

Variable expenses, on the other hand, tend to have minds of their own. These costs fluctuate directly with your business activity. When sales ramp up, you can expect to spend more on customer support, manufacturing raw materials, sales commissions, and digital ad campaigns. If much of your business revolves around services, add in ongoing tech upgrades and support fees to the list. Notably, as you scale, you may find some efficiencies—but overall, higher sales usually mean these costs will climb.

Keeping both categories in check is essential for accurate financial forecasting. For example, if your projections show rapid growth over the next three years, it’s important to anticipate a corresponding uptick not just in variable costs but in certain fixed expenses, too—like hiring additional staff or expanding your workspace. Factoring in both ensures your financial documents tell the whole story, giving investors the confidence that you’re planning for growth with both eyes open.

How to Calculate a Sales Forecast for Your Startup

If you’re gearing up to impress investors, understanding how to build a credible sales forecast for your startup is essential. Here’s a straightforward approach you can use (and yes, investors will notice if you get it right):

Start by estimating how many units of your product or service you realistically expect to sell over a specific period (monthly or quarterly projections work best). This isn’t just a wild guess—ground your estimates in real data wherever possible:

- Research your industry norms. Look at competitors, market trends, and any historical data you can gather (even from beta testing or market surveys).

- Factor in market conditions—seasonality, economic changes, and buying habits could all nudge your numbers up or down.

Once you have your projected sales volume, multiply it by your unit price. This provides an initial estimate of sales revenue.

To bring further clarity—and believability—to your forecast, break this down:

- Consider customer acquisition channels (organic, paid, referrals, etc.)

- Estimate conversion rates for each channel

- Identify assumptions and document them for transparency (investors love this)

- For subscription, include Churn Rate.

For example, if you plan to sell 500 subscriptions at $19 each in your first month, your sales forecast for that month would be $9,500. Fine-tune this by adjusting for returns, promotions, or launch ramp-up.

A well-crafted sales forecast not only helps you steer your business, but also underscores to investors that you know your numbers—and your market.

Why Update Your Financial Forecast Regularly?

Think of your financial forecast like the farm’s maintenance schedule—vital, ongoing, and never a “set it and forget it” item. Investors expect your numbers to be current and realistic, not relics from last season. Regular updates ensure your forecast reflects today’s market dynamics, shifts in your business model, new competition, or surprises—good or bad.

As your startup grows, market realities and internal strategies will change. That’s why it’s an innovative practice to revisit your forecasts at least twice a year. If you’re facing significant changes—such as a new product launch, major customer wins or losses, or evolving regulations—don’t wait for the six-month check-in; update your numbers right away. This proactive approach demonstrates to potential investors that you’re steering the horse and the farm with your eyes wide open, continuously recalibrating for success.

Understanding Total Addressable Market (TAM) in Sales Forecasting

One of the cornerstones of any strong sales forecast is a clear grasp of your Total Addressable Market (TAM). Simply put, TAM represents the full revenue potential your product or service could achieve if you captured every possible customer within your target market—assuming perfect conditions, optimal pricing, and market fit.

By defining your TAM, you’re not just tossing numbers into a spreadsheet. You’re demonstrating to investors a thoughtful approach to evaluating opportunity size and market demand. For example, if you're developing an innovative health device, you'd begin by estimating the number of people who could benefit from it, the healthcare professionals likely to recommend or use it, and the existing products you seek to improve upon or replace.

TAM serves as your starting point for sales projections and helps set realistic expectations for both you and your potential investors. It shows the ceiling your business could theoretically reach, ensuring your forecasts aren’t wishful thinking, but grounded in concrete market realities. When you incorporate TAM into your financial and go-to-market planning, you’re raising the bar of credibility and aligning your vision with quantifiable, attainable goals.

Understanding Breakeven: What It Means (and Why It Matters)

You’ve mapped out your business, projected your sales, and compiled your expenses. But how do you know when all that hustle finally turns into profit? That’s where your breakeven point comes in—the moment your income matches your outgoings, and every dollar earned after that is pure upside.

There’s no magic number for how long it takes to break even. For some, it’s a sprint; for others, it’s a marathon. Look at legends like Amazon or Tesla—Amazon didn’t hit breakeven until its ninth year, and Tesla kept at it for 17. Even Toyota took over two decades to turn a profit. The timeline depends on your growth strategy and the extent to which you reinvest in development, marketing, and scaling.

For investors, breakeven is a crucial benchmark—not just a feel-good milestone. They want to see that your business can cover its costs from operational revenue, not just founder paychecks or outside infusions of cash. Remember, this isn’t about whether you’re drawing a comfy salary; it’s about whether your company is healthy and self-sustaining in the big picture.

Careful cash flow forecasting feeds into all this—predicting when you’ll cover your expenses and how much runway you actually have before needing extra funds. Investors will drill into your projections to understand when the business shifts from surviving to thriving. Ultimately, knowing your breakeven isn’t just accounting—it’s how you communicate your startup’s momentum and long-term viability.

Financial Forecasting vs. Planning and Accounting: What’s the Difference?

How does financial forecasting fit into the broader financial picture? In short, economic forecasting, financial planning, and accounting serve distinct yet complementary purposes.

Financial planning is your strategic roadmap. It’s all about defining long-term goals, mapping how you’ll reach them, and setting milestones along the way. Think of it as plotting your course on Google Maps before setting out.

Financial forecasting is more like your real-time traffic update. Using current and historical numbers (whether from your company or comparable ones in your industry), forecasting estimates where your business is heading financially—month by month, quarter by quarter. These projections help you spot opportunities and potential roadblocks before they appear, enabling smarter, faster decisions.

Accounting then zooms in on what’s already happened. It tracks and reports your actual revenues and expenses, providing a detailed, accurate record of financial performance to date.

While their focus differs, each discipline relies on the other. Your forecasts are based on accounting data, and your financial plan adapts as forecasts change. All three provide the clarity you and your investors need as your business grows.

Founder vs. Company Breakeven: Understanding the Distinction

When you’re seeking investment, it's crucial to distinguish between your own financial breakeven and your company’s breakeven point. Here’s what investors look at:

- Founder’s Personal Breakeven: This is when your salary or compensation from the business covers your personal expenses. It might feel like a milestone, but it’s not the one investors care about most.

- Company Breakeven: Investors are focused on when the business itself starts generating enough revenue to cover all its costs—including payroll, operating expenses, and overhead—without relying on outside funding.

So, even if you’re earning a sustainable income, the business hasn’t truly “broken even” until it’s self-sufficient and paying its own way. Founders often choose to reduce—or even forgo temporarily—their salaries to help the company reach this key turning point faster, signaling commitment and strategic thinking to potential backers.

You might be wondering, “Is it really a red flag if a startup’s breakeven point seems far away?” Not always! In fact, some founders intentionally defer profitability. Why? It often comes down to a bold growth strategy. Rather than pocketing early profits, these companies reinvest heavily in research, product development, and market expansion—fueling innovation and capturing greater market share before focusing on margins.

Consider big names like Amazon or Tesla, which famously delayed profitability for years as they poured resources into building infrastructure and outpacing competitors. While this approach can raise questions among investors, it’s not automatically a red mark. What matters most is having a clear, well-communicated plan that explains the rationale for the delay and outlines how today’s investments are expected to deliver even greater returns.

For investors, it’s all about strategy and signals: if you choose to delay breakeven, be prepared to discuss how that decision positions your business for long-term success and sustainable growth.

How long does it actually take to reach breakeven?

If you’ve crunched the numbers and mapped out your financials, the big question naturally follows: how long before your business gets out of the red and crosses into profit territory?

There’s no one-size-fits-all answer. While you might hear “two to three years” tossed around as the magic number, real-world results span a much wider range. Take, for example, giants like Facebook, which reached breakeven in five years; Amazon, which needed nine; or Tesla, which spent a lengthy 17 years before turning a profit. Even stalwarts like Toyota didn’t reach profitability—it took them 26 years.

Does this mean a slow path to breakeven is doom and gloom? Not at all. In many cases, businesses consciously allocate resources to R&D or growth with an eye on greater returns down the road. When your projections show profit is a ways off, just be sure you can present a clear, compelling strategy to investors about why that runway is necessary—and how it positions your company for long-term success.

Our case studies

See all projectsGROW TRAFFIC & INCREASE REVENUE

Tell us about your project

Let us help you get your business online and grow it with passion

Contact us and we will create and deliver bespoke digital strategies. Get solutions with the biggest impact for your business.

Testimonials

SEE ALL“We could not be happier with your online marketing. You've cut down our spend, increased our ROI, and optimized our website in a very small amount of time! I am so pleased that I recently recommended Incognito Worldwide to several friends!.”

“You guys are amazing. For new client I refer, you analyze it and build a website that reflects who they are, handle all the setup of their social, emails, etc., and always deliver on SEO/PR campaigns for us. We get constant compliments on how beautiful the website are. Thanks!”